QCI #009 - Dedollirazation

The Chinese government has developed Alipay and WePay, and the Brazilian government has developed PIX, which is a functioning and nationally adopted VISA and Mastercard alternative. When BRICS, now with Saudi Arabia, create their own EURO currency, along with the rest of BRICS, half the world's Oil Market will transact in the absence of the United States.

Every time Oil is transacted with the Petrodollar, which is the case for all international transactions today, the US takes home a percentage-based transaction fee. This is the main reason why countries buy US-Sovereign Debt: to earn a yield to pay Petrodollar transaction fees.

US Sovereign Credit is heavily dependent on the Petrodollar, with half the world's economies and half the world's Oil Market forming a coalition with their own currency and payment processor, half the world's demand for the US Dollar mostly disappears.

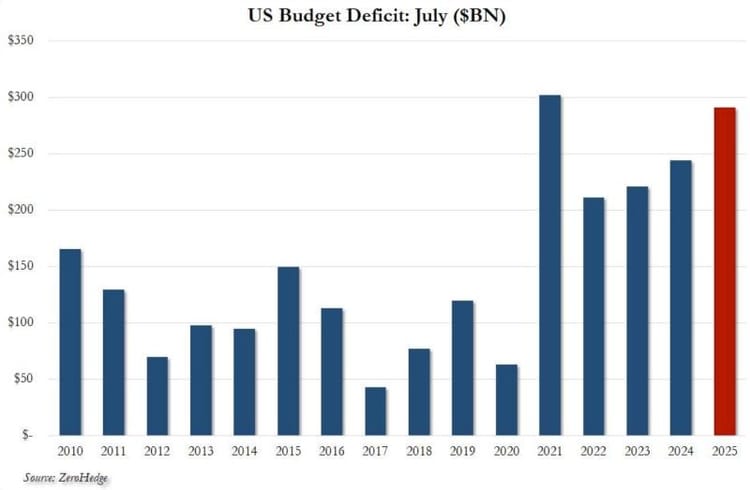

USD Debt is currently at $37 Trillion, US GDP is estimated to be at $30.33 Trillion. Oil and Gas extraction accounts for 2% of the US GDP. The Petrodollar system indirectly impacts the economy by lowering interest rates, as foreign oil exporters recycle Dollars into US Treasuries, thereby reducing borrowing costs. Stronger Global Demand for USD, boosting the US financial sector's ability to operate and purchasing power. The key direct factor that is impacted first is the geopolitical leverage that comes with the Petrodollar, making the Dollar the world's reserve currency, enabling the US to run trade deficits more sustainably.

Global De-dollarization's impact on the US GDP is between 2% to 3%. The Dollar's reserve status contributes about .5% to 1% of GDP annually in cheaper financing and international seigniorage benefits. The Oil and Gas sector contributes another 2% to 2.5% of the US Annual GDP.

What De-dollarization does is create a chip in the US's armor as it allows competing economies to develop freely, independent of the US Economy, which is the first step to the diminishment of America's Global Dominance, established after World War II.

The Buffer for the time being is that Central Banks still hold about 60% of their foreign exchange reserves in Dollars, and English is the world's most widely spoken language.

Member discussion